Introduction

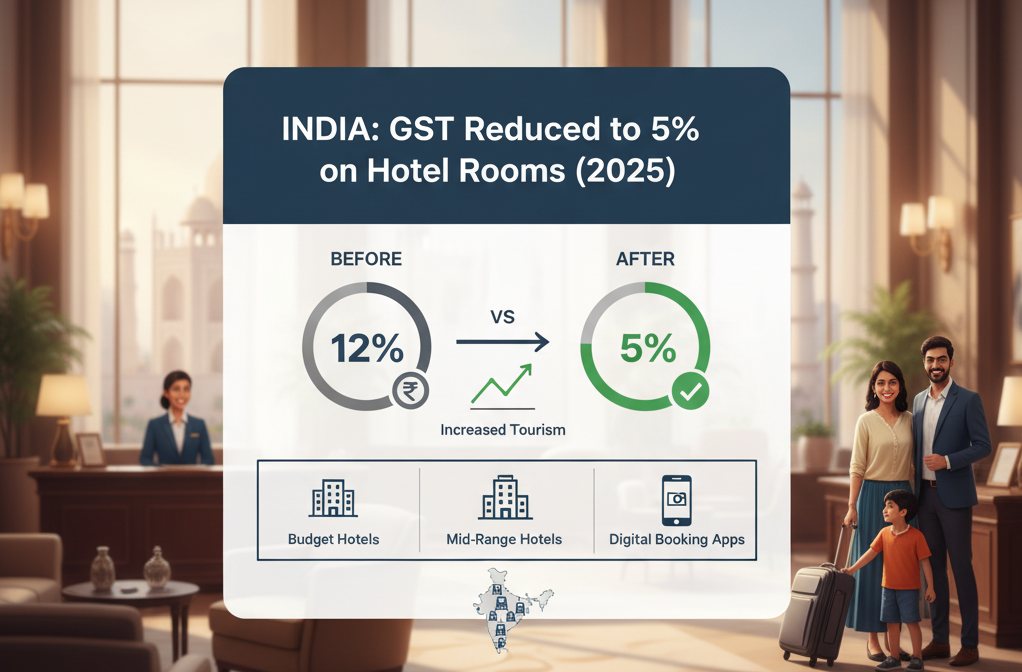

In 2025, the Indian government implemented a major reform in the Goods and Services Tax (GST) system affecting the hospitality sector. A key change is the reduction of GST on hotel rooms under ₹7,500 from 12% to 5%.

New GST Slab for Hotel Rooms

- Previous Rate: 12% GST on rooms below ₹7500/night

- New Rate: 5% GST (without input tax credit)

- Effective Date: 22nd September 2025

- No change to the 18% GST for rooms ₹7500 and above

Thanks for reading this blog!, Looking for professional help with your hotel listings?

👉 [Sign up with SaasAro] or call 75000-87037 today!

If you’d prefer to handle the listing yourself, keep reading and enjoy the complete blog below.

This reform represents a significant step in promoting domestic travel and making India’s hospitality sector more competitive.

This blog will explore the implications of this GST rate on hotel rooms in India, focusing on:

-

Impact on hotel pricing: How the new hotel GST slab India 2025 can reduce overall costs for travelers.

-

Effect on tourism: Increased affordability is expected to attract more domestic tourists.

-

Benefits to the hospitality industry: Hotels may experience higher occupancy, better revenue management, and more competitive pricing strategies.

By understanding this India hotel tax reduction, travelers, hotel owners, and industry stakeholders can make informed decisions in 2025 and beyond.

Understanding the New GST Structure for Hotels

The 2025 GST reforms have introduced a structured taxation system for hotels in India. Here’s a clear overview of the GST rules for hotels under ₹7,500 and how they differ for luxury and budget accommodations:

| Category | Room Tariff | GST Rate | Input Tax Credit (ITC) | Notes |

|---|---|---|---|---|

| Non-Specified Premises | ≤ ₹7,500/night | 5% | Not eligible | Applies to budget and mid-range hotels. More affordable for domestic travelers. |

| Specified Premises (Luxury Hotels) | > ₹7,500/night | 18% | Eligible | Luxury hotels can claim ITC, allowing better cost management. |

- Rooms ≤ ₹7,500/night: 5% GST without ITC. Hotels cannot claim input tax credit, slightly impacting cost structures.

- Rooms > ₹7,500/night: 18% GST with ITC. Luxury hotels can offset taxes paid on inputs, improving profitability.

This classification differentiates specified premises hotel GST and non-specified premises GST rules, helping both hotel operators and travelers understand pricing clearly.

Impact on Different Hotel Segments

The 2025 GST reform affects hotel segments differently, creating both opportunities and challenges across the hospitality industry.

Budget and Mid-Range Hotels

Budget and mid-range hotels, classified under non-specified premises, now benefit from the reduced GST rate on rooms ≤ ₹7,500, making stays more affordable for domestic travelers.

Benefits:

-

Affordable hotel stays in India: Lower GST encourages more bookings and higher occupancy rates.

-

Increased competitiveness: Hotels can attract cost-conscious travelers without drastically changing pricing structures.

Challenges:

-

Hotels cannot claim Input Tax Credit (ITC), which may affect profitability and operational cost management.

-

Careful pricing strategies are needed to maintain healthy margins while offering competitive rates.

Luxury and Star-Category Hotels

Luxury hotels continue to charge 18% GST on room tariffs above ₹7,500, classified as specified premises.

Benefits:

-

Eligibility for ITC allows these hotels to offset taxes on inputs, supporting smooth operations and cost management.

-

Maintains premium positioning while ensuring compliance with the luxury hotel GST 18% rules.

The new GST structure balances affordability for budget travelers while ensuring that luxury hotels can continue operations efficiently. This creates a more structured and fair taxation environment across all hotel segments.

Broader Implications for Tourism

The 2025 GST reforms are set to create a ripple effect across India’s tourism and hospitality sectors. By reducing GST on hotel rooms under ₹7,500, the government aims to make travel more affordable while stimulating growth in the industry.

Domestic Tourism Growth

-

The lower GST on hotel accommodation makes travel more budget-friendly, particularly for middle-class and cost-conscious travelers.

-

More affordable stays encourage longer trips, higher occupancy rates, and increased footfall in popular tourist destinations.

-

This change is expected to significantly boost domestic tourism in 2025 and beyond.

International Competitiveness

-

The new GST rate on room tariff helps align India’s hotel pricing with global standards.

-

Competitive pricing makes India a more attractive destination for international travelers seeking value-for-money accommodations.

-

Luxury and mid-range hotels benefit indirectly as budget travelers explore more destinations, creating opportunities for premium services.

Investment in Hospitality Infrastructure

-

Reduced GST on mid-segment and budget hotels stimulates investment in the hospitality sector.

-

Developers and entrepreneurs are more likely to invest in homestays, guesthouses, and mid-range hotels, strengthening India’s tourism infrastructure.

-

This can lead to improved facilities, enhanced guest experiences, and a more vibrant tourism ecosystem.

The impact of lower GST on tourism is multifaceted — it encourages domestic travel, improves international competitiveness, and drives investments in India’s growing hospitality sector. These hospitality GST changes in India are likely to create a more dynamic and accessible travel environment in 2025.

How Saasaro Helps Hoteliers

The new hotel GST slab India 2025 creates opportunities for hoteliers, but managing compliance and pricing can be challenging. Saasaro provides an all-in-one solution to help hotels adapt efficiently and maximize profitability.

Automated GST Compliance

-

Saasaro simplifies invoicing and ensures accurate application of the GST rate on hotel rooms in India for rooms under ₹7,500 and above.

-

Reduces manual errors and keeps hotels compliant with the latest GST rules.

Real-Time Tax Calculation & Reporting

-

Automates tax calculations for both ITC-eligible and non-eligible cases, helping hoteliers stay on top of financial reporting.

-

Streamlines accounting processes, saving time and reducing operational overhead.

Boosting Profitability & Occupancy

-

Helps hotels optimize room pricing and promotional strategies to leverage the 5% GST on affordable stays.

-

Attracts more guests by highlighting affordable hotel stays in India, increasing occupancy and revenue.

Integrated Booking & Revenue Management

-

Ensures smooth operations for budget, mid-range, and luxury hotels through centralized booking and revenue tools.

-

Improves efficiency and decision-making, enabling hotels to respond quickly to market changes.

Future Outlook

The 2025 GST reforms are shaping a more structured and competitive hospitality sector in India. Understanding the hotel GST slab India 2025 and anticipating future trends is essential for both hoteliers and travelers.

Market Dynamics

-

The reduction in GST on rooms under ₹7,500 promotes a competitive and transparent hospitality market.

-

Hotels are likely to optimize pricing strategies to attract more domestic and international travelers.

-

Increased affordability may encourage greater competition among budget and mid-range hotels, ultimately benefiting travelers with better services at reasonable rates.

Policy Evolution

-

Continuous monitoring of GST rate on hotel rooms in India is crucial, as future policy changes could further impact room tariffs and Input Tax Credit (ITC) rules.

-

Staying informed allows hotels to leverage tax benefits effectively and make strategic investment and pricing decisions.

-

Adaptability to evolving GST policies will ensure sustained growth and competitiveness in the hospitality sector.

The new GST structure sets the stage for a dynamic and transparent hotel market in India. By keeping track of the hotel GST slab India 2025 and adjusting strategies accordingly, hoteliers can maximize profitability while offering better value to travelers.

Conclusion

The reduction of GST on hotel rooms under ₹7,500 to 5% in India marks a significant milestone for the hospitality and tourism sectors in 2025. This reform not only makes domestic travel more affordable but also encourages higher occupancy rates for budget and mid-range hotels. While luxury hotels continue to operate under 18% GST with input tax credit benefits, the overall market is expected to become more competitive, transparent, and attractive for both investors and travelers. Hotels and tourism stakeholders must adapt strategically to leverage the benefits of the new GST structure, thereby contributing to India’s tourism growth and strengthening the hospitality ecosystem.

FAQs

1. What is the new GST rate on hotel rooms in India under ₹7,500?

The GST on hotel rooms priced up to ₹7,500 per night has been reduced from 12% to 5% in 2025.

2. Are hotels charging under ₹7,500 eligible for Input Tax Credit (ITC)?

No, hotels charging room tariffs under ₹7,500 cannot claim ITC, which may impact their cost structures.

3. What GST rate applies to luxury or star-category hotels?

Rooms priced above ₹7,500 per night are considered specified premises and are subject to 18% GST, with ITC eligibility.

4. How does the GST reduction affect budget and mid-range hotels?

The 5% GST makes stays more affordable, likely increasing occupancy rates, but the no-ITC rule may affect profitability.

5. What is the expected impact of lower GST on tourism in India?

Lower GST is expected to boost domestic tourism by making travel more affordable and stimulating investment in mid-segment hotels and guesthouses.

6. Will this GST change affect international travelers visiting India?

Yes, the lower GST on budget and mid-range hotels aligns India’s pricing more competitively with global standards, enhancing its appeal to international tourists.